Like many other industry groups, the National Retail Federation (NRF) fiercely opposes the Trump administration's proposed tariffs on China and other U.S. trading partners. Now they have the numbers to show why furniture retailers should be deeply concerned as well.

A new study prepared for NRF by the Trade Partnership, a D.C.-based consulting firm that "offers an expanded global reach on issues related to trade policy and international markets," found that if the proposed tariffs on $200 billion in Chinese goods would cost American consumers as much $4.3 billion on furniture purchases per year.

That number should be shocking, but there's quite a bit to unpack with this study. Here's how furniture may be impacted by tariffs and what furniture retailers should know now.

Worst case and even-more-worst case

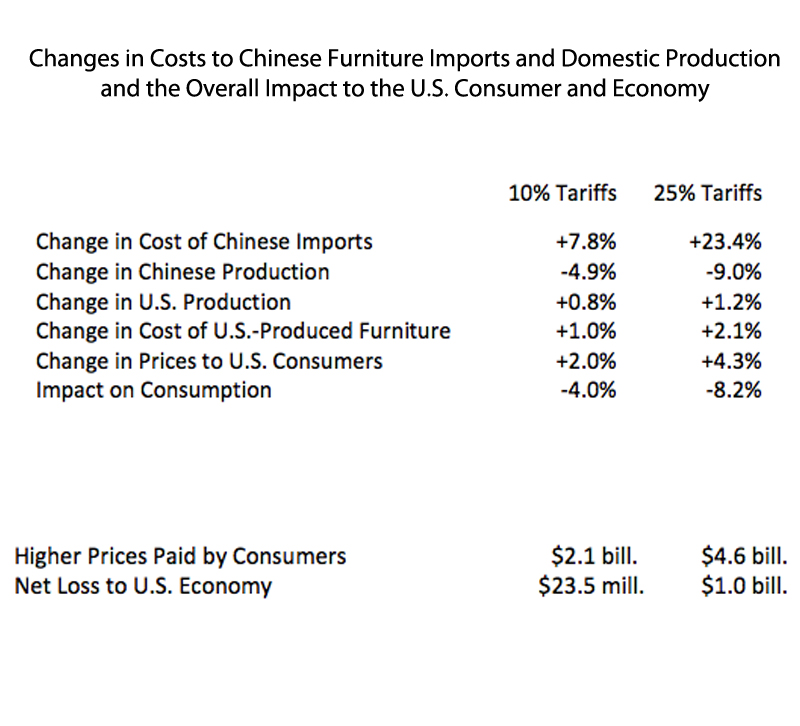

At press time, it is unclear about what the final tariff percentage will be, but it's hovering between 10 and 25 percent. That's a significant gap, so the Trade Partnership calculated both numbers to give a worst-case scenario and an even-more-worst-case scenario. Neither one paints a happy picture for retailers or consumers.

Regardless of what the actual tariff percentage ends up being, American consumers will still pay between $2.1 and $4.6 billion for furniture than they do without tariffs. For each year the tariffs remain in place, the U.S. economy will lose between $23.5 million and $1.0 billion.

In theory, tariffs should discourage to consumers to buy foreign goods and instead buy American-made goods, which would theoretically be cheaper, but that's not case, according to the Trade Partnership. Whether U.S. manufacturers use Chinese or American-made parts in production, the cost for both will likely increase due to tariffs on other products such as steel and aluminum (which caused a nail factory to layoff workers and maybe close) and potentially lumber (it's already driving up the cost of new homes). While manufacturing will likely increase between 0.8 and 1.2 percent, the cost of U.S.-produced furniture will also go up to meet the increase in demands.

How furniture retailers will likely be impacted

Consumption of furniture goods is expected to decline no matter what — between 4 and 8.2 percent — if/when tariffs go into effect.

At 10 percent, the cost of imported furniture would rise about 8 percent, which some retailers might be able to absorb. It would mean lower margins certainly and pose other problems for retailers, but customers wouldn't have to pay the added cost, which at least looks good to them. At 25 percent, however, that cost skyrockets up to 23 percent, far too much any retailer to reasonably absorb. Prices on furniture would have to increase.

As Sharron Bradley, CEO at the Home Furnishings Association said back in June, home furnishings purchases usually come from discretionary spending. Customers may hold off on purchasing furniture in general or they may go after lower-quality and lower-priced goods, even for important products like sofas and dining room tables. Average order sizes will also more than likely drop, and retailers may have a smaller pool of potential customers but an even larger pool of competitors. More might turn to new start-up solutions such as bed-in-a-box mattresses or flat-pack sofas from Campaign Living or Floyd.

There's not much that furniture retailers can do right now. All the industry can do is wait and see what the tariffs will be, but one thing's certain: High Point Market buyers may feel very different at fall market.

Share with us: How are you preparing for tariffs?

Photo: Global Views