In 2005, Marshall Field & Company announced its flagship store on State Street in Chicago would be changed to Macy’s. What would become of the iconic green clocks that overlooked State Street? Who would decorate the windows at Christmastime?

Macy’s moved in. The clocks ticked; the windows shined. The city moved on. Until April 2017 when Macy’s decided to sell floors eight through 14 of its State Street location. Only this time, there hasn’t been a bigger retail giant to move in.

The home retail and design industry usually welcomes change and embraces new technology, especially when it means Macy’s, Pottery Barn, Crate and Barrel and other big-box giants feel the noose of the internet. But their downfall won’t directly result in the rise of showrooms. If Macy’s is Darth Vader, the internet is Emperor Palpatine.

Today, competition with online retailers is only part of the problem the internet poses to showrooms and designers. New start-ups, tools and changing demographics could leave an even bigger impact on the industry and change the way the next generations shop for lighting, furniture and design. If these new challenges are to be met — and rest assured, they can — the first step is to understand them.

Brave New Online World

At a spring High Point Market panel discussion in the dark High Point Theater, moderator Keith Granet asked interior designers Ron Woodson and Jaime Rummerfield, Elizabeth Brown, CEO of Viyet, and Stacey Osiecki, Digital Director of Resource Décor, what they would never buy online. Woodson glanced down and said, “This chair.”

Rummerfield agreed. Both designers, partners in the Los Angeles-based firm Woodson and Rummerfield’s House of Design, balked at the idea of buying furniture online, but when Granet reached Brown, she answered simply: nothing.

“For me, as long as there’s a return policy and its not final sale, I’ll buy pretty much anything online,” Brown says.

Brown’s ecommerce company, Viyet, helps consumers and manufacturers buy and sell gently used designer furniture. Launched in 2013, the company fills a void by helping people buy and sell their gently used designer furniture, and it helps manufacturers sell off extra showroom pieces.

“As we grew and as word got out,” Brown says, “we recognized that this is not just a problem for individuals.”

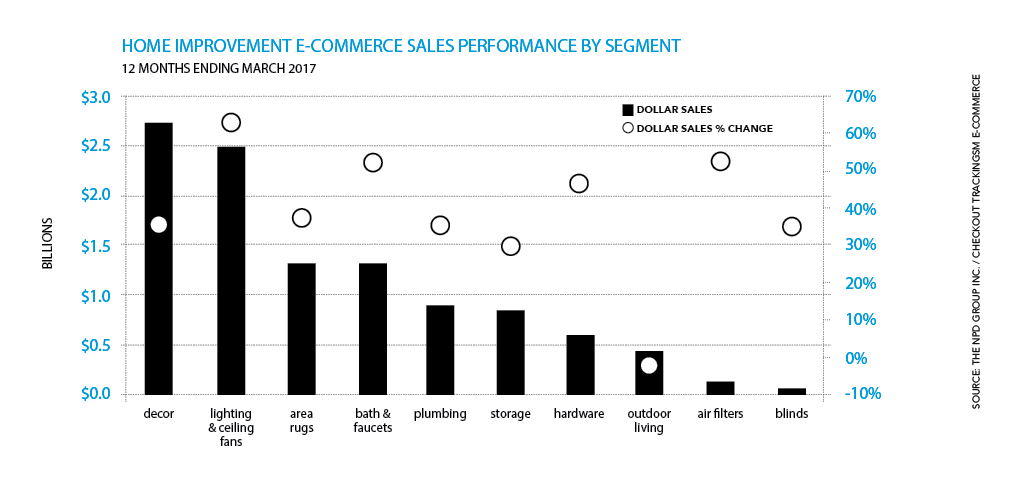

Consumer fears about buying lighting and decor online have faded, and furniture may not be far behind. A new study from The NPD Group released in May 2017 reported that online sales of home improvement products — anything from plumbing and hardware to sofas and decor — grew 41 percent over a 12-month period ending March 2017. Home decor, area rugs, lighting fixtures and lamps saw the largest online sales gains. NPD Group Executive Director and Industry Analyst Joe Derochowski says during the 2016 holiday season, the home industry grew the fastest. Though furniture may not be in that category, Derochowski sees no reason why it won’t be in the future.

What has eased consumer fears? The answer could be the virtual elephant in every store: Wayfair. Over the last few years, Wayfair invested in augmented reality, which allows users to virtually place items in their home using their camera phones. Its augmented reality platforms are available on the Wayfair app as well as Asus Tango-enabled ZenFone AR and other virtual reality devices.

And Wayfair isn’t the only one investing in augmented and virtual reality: IKEA, Home Depot and Pottery Barn have also invested in this technology. Suddenly, the biggest hurdle of buying furniture — or any home product — has disappeared.

Valuing Design

Interior designers may not be selling products, but their services are not immune from digital competition. One of many interior design service websites to crop up over the last few years, Havenly.com, connects clients with local interior designers who want to lend their services. Clients choose one of three price points (one of those three is free, by the way) and work with a designer through video chat and email to assess the space and help the client pick out furniture, lighting and decor from Havenly’s extensive database.

Matt Erley, Senior Director of Growth at Havenly, says most projects on Havenly fall between $1,500 and $2,000, but the site also attracts people with less than $500 for a budget. The company targets females — married, homeowners, ages between 30 and 45, one or two kids — and they’re looking to update a space or mix in different design elements.

“Where Havenly is really fitting is that you don’t need to have a massive budget to create a beautiful space,” Erley says.

Havenly and others like it could hit the interior design community by targeting a demographic that isn’t quite ready to invest in an interior designer but wants a nice-looking home. Part of the expense of interior design comes from paying the actual designer. With Havenly, there’s more money to be spent on furniture and lighting. As Millennials struggle to pay rent, student loans and other bills, the draw of Havenly may be too great.

By hitting Millennials young, Havenly educates. Its free version allows clients to ask interior designers specific questions (i.e. “I’m looking for a rug. Here’s my space. What do you think?”), and the one-on-one chats give designers time to educate clients on how to buy furniture.

Right now, the Millennials designers are working with have made their money young or have help from parents. In another 10 years, will now-financially-stable Millennials in their 40s want to pay a designer?

Keep in mind, these are different types of Millennials. These are Millennials that are currently paying off student loans (Inc.com reported earlier this year that 63 percent of Millennials have more than $10,000 in student debt, over a third have at least $30,000)) and might still be paying them off in their 40s. According to Millennial Marketing, Millennials are 23 percent more interested in traveling abroad than Baby Boomers, and 78 percent said they would rather splurge on an experience rather than a “thing.” In 2014, Nielson reported that 62 percent of Millennials preferred to live in cities or “urban centers” — which translates to small spaces. Not to mention Millennials watched firsthand as the Great Recession wrecked the economy, making them an extremely cost-conscious generation.

The 2016/2017 State of the Industry outlook from the American Society of Interior Designers announced: “Interior design is a strong and growing sector” with more than 68,000 designers employed nationwide up 11.9 percent from 2015. But even five years ago, retail was a strong and growing sector. Macy’s isn’t the only once-profitable brand in trouble. Neiman Marcus’s owners scrapped their plans for an IPO and now want to sell. Sears, Kmart and HHGregg have become chapters in the history of retail.

If department stores continue to downsize, is it possible that the interior design industry could face a downsize as well?

More Than a Trend

Derochowski calls himself a “consumerist at heart.” Since 1998, he’s tracked trends in the home industry, everything from house wares to major appliances, and followed $1.8 trillion worth of business. In his mind, the home industry couldn’t be in a better position.

“The home industry is in the best window it’s going to be in the next five to seven years since the 1970s,” Derochowski says.

Two key demographics — Millennials and Baby Boomers — have both hit the perfect window, Derochowski explains. According to the U.S. Census, Millennials overtook Baby Boomers as the largest living generation in 2016. More Millennials are hitting milestones like marriage (average age: 29) and home buying (average age: 32). More Boomers are empty nesters, and Derochowski says one-third of retiring Boomers are moving 300 miles from their current homes.

“Anything related to the home industry is actually doing well because people are hitting these windows,” Derochowski explains.

But it’s more than just the demographics. Derochowski says the ease of communication has enabled what he calls “one-plus-one-equals three opportunities,” where one generation is able to influence the other.

Adult Millennial kids talk to their Baby Boomer parents more than previous generations through text messages, FaceTime and other platforms. In seconds, they share photos, videos and links back and forth.

When Millennials want advice on buying a product, they show the product to their Boomer parent before purchasing, whether that means sending a link or a snapshot taken using an augmented reality tool. The Boomer parent offers feedback and then starts looking at the brand. The same thing can happen in reverse with Boomers asking for advice from their Millennial kids, but the result is the same: Both generations expose each other to brands and products.

“Next thing you know,” Derochowski says, “you’ve got both of them selling it to each other.”

Consumers develop shopping habits young. Millennials came of age when almost anything could be ordered online — and some of it delivered in hours. They’ve had more positive than negative experiences buying products online, and as Brown said, the return policy is usually enough to reassure buyers. It will be difficult to break Millennials of these habits, especially as augmented reality technology improves.

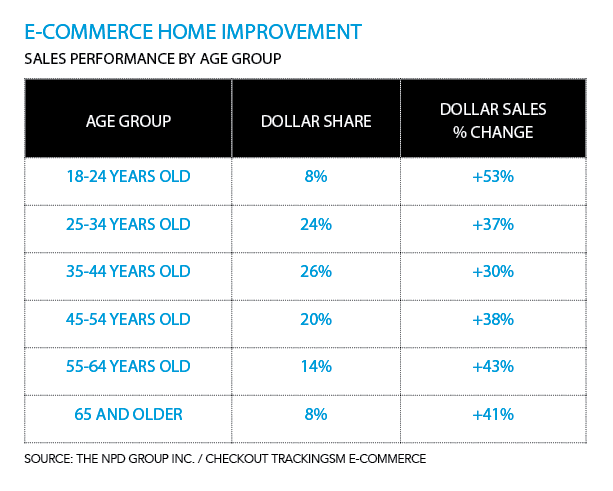

When NPD broke down the e-commerce home improvement sales’ performance by age group, Millennials ages 25 to 34 took 24 percent of the total dollar share while Boomers only took 22 percent. The shift in consumer power is already turning to Millennials.

If stores have yet to see a lot of Millennial customers, it’s not because those customers don’t exist or don’t care about their homes. On the contrary, Derochowski explains, the home has become more important to Millennials. They care about good, healthy food and saving money, so they cook more meals at home. They entertain more at home. They’re shopping. They’re just online, and when they need advice, they’re not looking to showroom associates or designers: they’re messaging their parents and friends.

The State of the Industry

When faced with a giant such as the internet, it’s easy to turn inward and bury heads in the sand, but if showrooms and designers have any hope of keeping their business open past the next decade, then they’re going to have to confront Millennials and show buyers the value of their services.

Make no mistake: There is value. The expertise of sales associates in lighting and furniture showrooms cannot be matched by blogs and Wiki how-tos, and all the augmented reality apps in the world cannot replace the confidence that a skilled interior designer possesses and clients depend on.

Even Viyet’s customers rely on humans, more than Brown predicted. The company employs freelancers around the country who authenticate pieces, take dimensions and note colors. Their customer service team is briefed on all products, and many buyers call customer service often for reassurance of their purchase. In fact, Brown estimates that one-third of all purchases are actually done over the phone.

“I think that human touch does go along way,” she says.

But it’s not enough to believe in the need for showrooms and designers; they need to be showing their value all the time. When it comes to showrooms, Derochowski says they should be concerned with creating experiences and mastering their digital strategy.

“You either better get in there,” he says, “or don’t complain when you lose the business.”

Where real-life — not virtual — showrooms and designers can excel is creating one-of-a-kind experiences for consumers that they could never get online. As Millennials get engaged and buy their first homes, showrooms should be offering personal appointments for Millennials (or really anyone) to come in and learn about lighting and furniture. This lays the foundation for associate-buyer relationships that last through homes — and marriages.

For designers, blogging and actively posting on social media are musts, but hosting events and seminars may also help you build up your following in the community. Seminars on small space decorating, sustainable design or vintage furniture educate consumers on why good design matters. When the time comes, they’ll see the value in going to you instead of striking out on their own.

The green clocks above State Street keep time for Macy’s just as they did for Marshall Fields. They ticked when the Sears Towers became the Willis Tower and when Comiskey Park became U.S. Cellular Field and now Guaranteed Rate Field. Time marches on, and now the home design industry must make a choice: March on and embrace change, or wait for the end.

Orange is the New Green

While Macy’s and Sears may be falling, there’s one big-box giant that’s still raking in the green: Home Depot. According to the most recent numbers from Michael E. Kanell at the Atlanta Journal-Constitution, the company’s winning retail and online strategies show that it’s willing to adapt to the trends of its customers and the market.

Here’s how the home improvement giant is navigating the retail landscape:

Fast Facts

- -Home Depot’s revenue has risen by 43 percent over the last seven years. In the 2016 fiscal year, the company posted $94.6 billion in revenue.

- -The average tab per Home Depot customer has risen 16.6 since the recession, now at $60.35.

- -In 2008, Home Depot shelved plans to build 50 new locations, and it closed 15 stores. Since then, new store openings per year have been in the single digits.

- -Despite few new store openings, the company’s total workforce has grown by 26 percent since 2008.

- -With Sears stores closing, Home Depot estimates that it captured 51 percent of their appliance sales by expanding their inventory.

- -Home Depot’s online business makes up just 5.8 percent of its total revenue, but that number is still rising.

- -Of those items purchased online, 45 percent are picked up in a store, and 25 percent of the time, customers end up buying more products while they’re there.

What We Can Learn

- -Fewer homeowners are building, but over half are planning or continuing a home renovation project this year, according to the 2017 Houzz and Home Report. Targeting contractors and designers rather than consumers could open a new revenue flow.

- -One company’s loss is another’s gain. Pay attention to which stores (if any) are closing in your area and how you could pick up that company’s sales. For example, if a hardware store closes near you, then you might consider stocking light bulbs or simple tool kits.

- -Budgeting for additional employees may be difficult, but look for new opportunities to train the ones you have. Look for webinars and take advantage of training seminars at trade markets.