When it comes to setting prices, retailers are tasked with striking a delicate balance. Price items too low and you won’t turn a profit; price items too high and they’ll never leave your showroom floor. Many factors are involved in setting retail prices, from vendor suggestions and policies to the pricing strategy of your competitors.

One key question it’s important to ask is: How much are your customers willing to pay? While each business has its own target ideal consumer and corner of the market, it can help to know some ballpark stats on what consumers are willing to shell out for home furnishings. Read on for some illuminating research.

Consumer Spending Habits

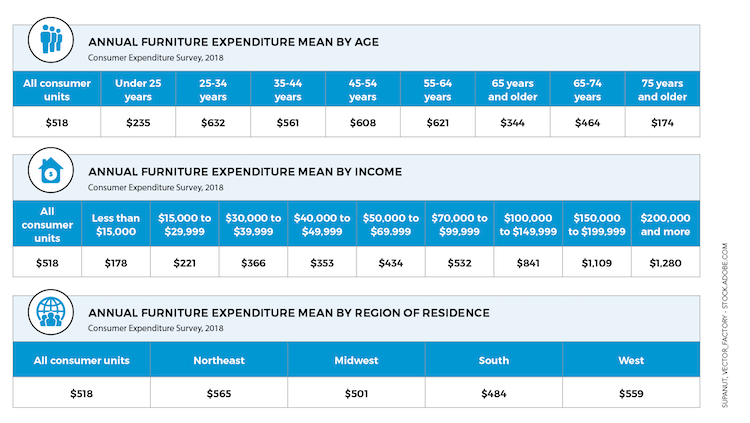

Research from the Bureau of Labor Statistics’ 2018 Consumer Expenditure Survey offers insight into what consumers are actually spending on furniture, broken down by age group, income and U.S. region in the tables below.

When Do Consumers Splurge?

Consumers usually have a budget in mind for any given home furnishings purchase — but what factors do they consider when it comes to stretching it a bit? A 2019 survey of 1,850 Americans by ImproveNet offers some insight. It found that consumers said they’ll spend a little extra on quality and style when buying a: 1. Sofa or sectional, 2. Mattress 3. Television, 4. Refrigerator and 5. Dining table/chairs, ranked in that order. According to uShip’s Dream Décor Report 2019, 31 percent of people are ready to pay more than their intended budget if they find the perfect item.

The ImproveNet survey also found that just 24 percent of respondents said most or all of their home is furnished and decorated to their satisfaction, meaning the desire is there for new home furnishings products. Twenty-three percent said very little of their home is furnished to their satisfaction, while 53 percent said some of it is. When it comes to financing furniture purchases, 19 percent said they have furniture-related debt, with the average amount owed at $1,350. Fourty-four percent said they have deferred payment on large items of furniture.

A Deloitte report found that furniture, among other categories like housing and food, constitutes about the same percentage of the consumer’s wallet today as it did in 1997.

Despite a changing retail climate, consumers are ultimately still spending a consistent amount of money on home furnishings, and they’re willing to splurge when it comes to quality and comfort. If you can make the case that your furniture is the right quality for the right price, you’ll position your business for success.