To get a better read on the buying public’s mindset heading into the new year, the Furniture, Lighting & Decor research team surveyed consumers across the country about what matters to them in the furniture buying process. The questions we asked ranged from where they would shop to whether they considered things like interior design services and customization important. The answers were, in a word, eye-opening.

We learned that local independent furniture retailers, long the backbone of the furniture industry, are no longer the first place that shoppers think of when considering a purchase. Certainly, while we expected to see evidence of more disruptive online activity — somebody is driving those Wayfair and Amazon figures after all — we were taken by surprise by how quickly one national, brick-and-mortar retail brand has achieved top-of-mind awareness. And, while consumers seem more interested than ever before in where the furniture they buy comes from and how it is made, fewer appear to be concerned about the pitfalls possible when purchasing products without the assistance of an interior designer.

Statistically sound and diverse though our sample was, since knowledge is power, we also sought boots-on-the-ground insights from independent merchants across the country. Our aim was to see whether the consumer responses mirrored what’s really happening on retail floors.

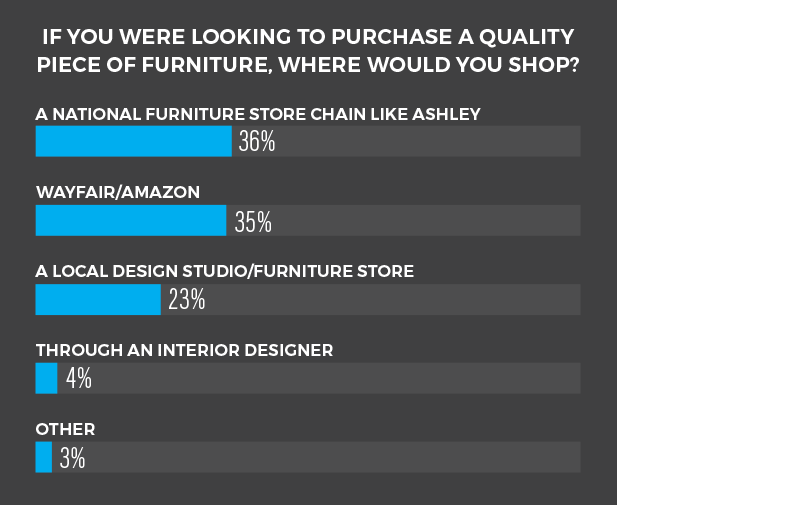

Where to Shop

Given that the Ashley HomeStore brand opened its 900th store in New Zealand last month, maybe the number-one answer—A national furniture store chain like Ashley (36 percent) — should not catch anyone napping. Launched in Anchorage, AK in 1997, the chain has grown to become the number-one store in North America in little more than two decades, with more than 400 stores added in just the past four years — making it the only truly national chain with a fast-growing international presence as well. Though many Ashley HomeStores are independently owned and operated, all of the furniture sold is manufactured by Ashley Furniture Industries.

"I’m not surprised by the Ashley answer at all,” notes Jeff Lenchner, CEO of Today’s Home, a high-quality, high-end furniture store launched 65 years ago in the Pittsburgh market that today also encompasses Designer Furniture Outlet. “There’s a reason why they’re doing $6 billion. We carry Ashley in our designer furniture outlet division and the perceived value of an Ashley product is exceptionally good. Don’t get me wrong, that doesn’t mean it’s made like a Sherrill sofa, but they do an exceptional job with their look and the relationship of the quality story for the price point. Since we started carrying the product, Ashley has opened dedicated stores in our marketplace, but their presence has had no effect on our Ashley business. It’s just added to the brand awareness. What I don’t understand,” he adds, “is the Wayfair/Amazon response (35 percent).”

“One thing our industry has done a very poor job of overall is telling customers ‘I will make your life better if you include my products in your home,’” says Lael Thompson, Chief Operating Officer at Sonshine Furniture Today, which owns and operates the Broyhill Home Collections store in Aurora, CO. “In my opinion, this is a direct result of marketing. The two answers with the highest responses are the companies telling the customer, ‘I will make you happy.’ Look at the Wayfair ads with happy people dancing around. Wayfair is saying, ‘Don’t you want to be like them?’” Ashley too “has been pounding national ads,” adds Preston Matthews, owner of Brown Squirrel, an independent furniture store in Knoxville, TN.

That’s an issue for independent retailers who relied on newspaper and television advertising and even radio to tell their stories for decades. Media fragmentation resulting in hundreds of television and satellite radio channels and the demise of local newspaper ads has made it extremely difficult for independent stores to get their messages across.

“The days of running a big, full-page newspaper [ad] are long gone, and even the days of running a bunch of ads on TV are over due to the expense,” says Eric Easter, CEO of multi-store chain, Kittle’s Furniture, based in Indianapolis, long an industry leader. “We used to be able to promote 24-hour sales, and weekend-long sales, but we can’t afford to spend the money to break through to do those anymore. You have to have a different kind of marketing strategy now. We’re in a lot of different places doing a lot of different things, but trust me, we haven’t figured it out yet because our traffic is awful.”

“Trying to get out there and advertise is the hardest thing now,” agrees Dru Jeppe, Chief Inspiration Officer at Reeds Furniture in Agoura Hills, CA, where the goal is to “inspire beautiful lives” by creating warm, happy and comfortable furniture shopping experiences. “There’s no real CRM, no real way to make deep customer connections aggregating all the data points and you really don’t know who your customer is,” the executive reports. “Wayfair and Amazon and these other people have all the data points connected and they know exactly how to touch people, even if they are selling them crap. They may be doing consumers a disservice, but the Walmart philosophy is completely entrenched in our industry and others.

“As an industry, we’re not explaining the life-time value of the product; it’s always about price and who can be the cheapest,” she says. “The suppliers do a very good job of articulating why things cost what they cost, but they rely on the retailers to convey why their products are more expensive, and the independents just don’t have the money to market the value of true quality.”

“Anytime an Ashley HomeStore comes into your area, they are going to do a lot of advertising and that freaks a lot of retailers out,” Thompson says. “And Wayfair is trying to scorch the earth until they put everyone out of business, and they are the last man standing. But they are also telling customers that they need furniture. If you can emulate that message, whether it’s via your Facebook page or creating YouTube videos, I believe it’s possible for independent retailers to draft off that and let them carve the headwind, just like a NASCAR driver that gets right up on the bumper of the guy in front of him. If they are pushing a certain color or style trend, I’m going to try to capitalize on their efforts and their willingness to put all those advertising dollars out there.”

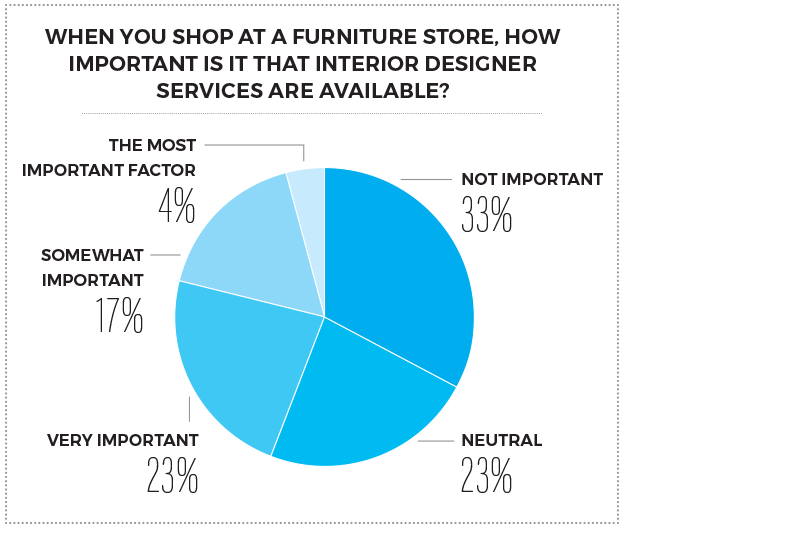

Design Guideposts

“Anytime you use the term interior design/interior designer when you’re talking to the masses, because their perception is that interior design services equal a higher price, so this may affect the answer to this question,” relates Matthews at Brown Squirrel, which dominates the Knoxville market with a reported 65 percent of share and has been steadily trading up its lifestyle presentation (the store has undergone a major facelift thanks to retail strategist Connie Post) adding brands like Bernhardt and Smith Bros.

“We have interior designers on staff, but the truth is that they represent maybe 14 percent of just one store’s business, and we’ve got eight stores,” Kittle’s Easter shares. “We’re very focused on connecting and communicating with customers, ‘tell me about your room,’ and that kind of thing, rather than labeling it design services, because it’s still intimidating to a lot of folks and certainly our younger customers.”

Notes Thompson, “We do not offer a formal interior designer, but it would be a mistake to say that we don’t help people design their rooms to get the look that they want. Most of the time, we find that when people say that they want help, it’s that they want help discovering what their likes and dislikes are, and they want to be counseled or guided to a solution. But they don’t think they need someone telling them what they want. I think that most of the customers that go into a furniture store and work with a designer have the feeling that they’re overpaying.”

Jeppe concurs. “Interior design assistance is available, but it’s not that important to our customers and most people don’t ask for it. What they want is help from their salesperson to make the right decision. I don’t think they want to put their trust in someone else and have to pay them, when they can get help in the buying process for free.” Additionally, she says, “We’ve tried to hire interior designers, but they can’t convert like a regular salesperson can.”

Even Lenchner at Today’s Home, where complimentary interior design services have been a part of the “core competency since 1953,” says the survey responses track with what’s happening on his floors. “Obviously, offering design help is very important to us, but if you were to poll my customers and ask them how important it is to enter the front door, I bet only 40 percent would say that it was critical. The other 60 percent are coming in because of our brand and the niche that we represent. Plus, there’s a lot of DIY going on, so a lot of times, we’re just the guidepost.”

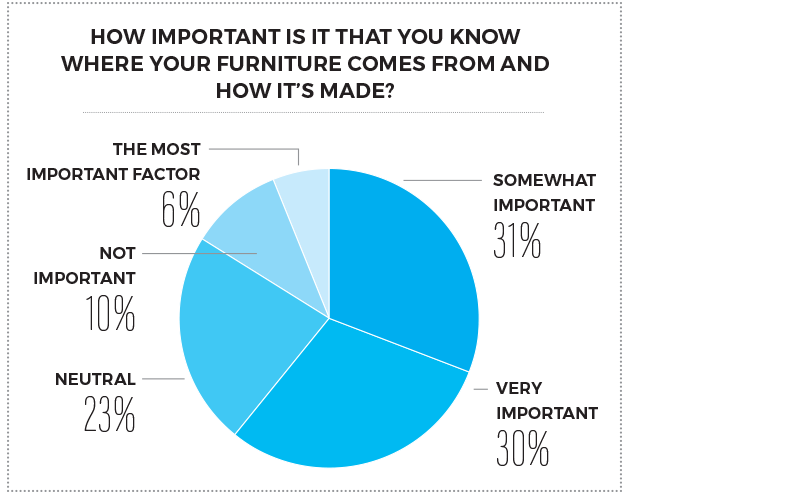

Origin of Product

“Made in America is more important now than it has been in the time that I’ve been in the industry, and my career when just about all furniture was made in America,” Easter relates. “But the world is different now and for a lot of reasons, we have some big signs at the front of every one of our stores that say, ’70 percent of what we sell is made or assembled in America.’ I would say it’s worked its way up to a tie-breaker in the minds of many people and it’s a differentiator for us in our markets, because we look across the street to Bob’s or Value City, Havertys, Ashley and whatever. So, we think it’s very important and our customers are telling us so.”

Still, while the survey shows increasing interest in domestic produced goods, according to Jeppe, price still trumps origin. “When you have it people like it, but it’s hard to find American-made products. A lot of our stuff is made in China and Vietnam, and the fact is that some of the best factories are in Asia. We don’t find the issue to be that important, because knowing something is made in America is not going to make them spend $300 or $500 more on a sofa.”

Also, although Reeds Furniture is currently liquidating some of its Chinese product in advance of the tariffs, and “actually putting promotion behind it,” she says that consumers are just not aware of the impact a 25 percent increase could have. “They are just not talking about it and my takeaway is that they are not informed, and either they don’t know, or they don’t understand it, which is amazing. I’m shocked.”

“At the low end, they just want price,” Thompson says, “and they don’t care how it got there or where it came from. But there is a more conscious customer that wants to make sure that what they’re bringing into their home was made ethically from the materials to the labor to the construction. So, we try very hard to educate and empower the customer, and part of that is speaking to how things are made because that supports the price points and builds confidence.”

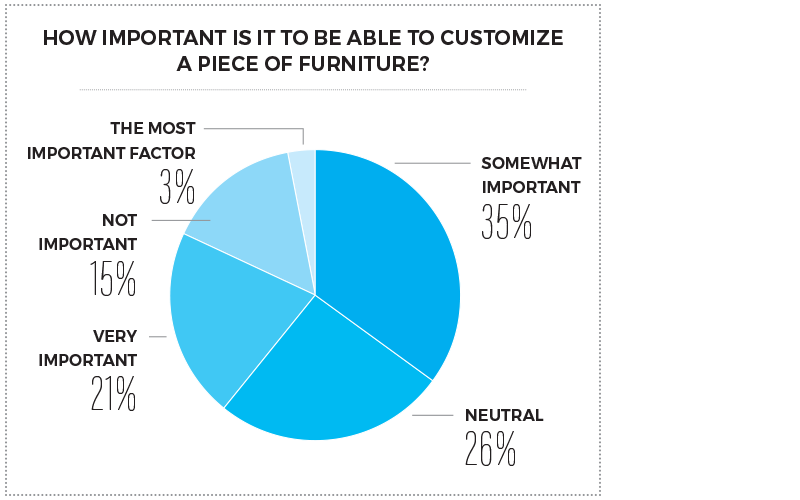

Have it Their Way

Customization plays a key and growing role at nearly all of the retailers surveyed and is, in fact, one way they can differentiate. Retailer Julie Hatridge at The French Quarter by JH Design in Bakersfield, CA — a 5,000-square-foot boutique that stands apart in its market with vintage goods mixed with names like Hooker, Bernhardt, Spectra Home and Magnolia Home draped in bling — customizes upholstery, pillows and decorative accessories for example. She says that it’s particularly important for older customers who want their homes to truly reflect their tastes, “but I’m also seeing greater interest from younger customers in personalizing their look.”

At Kittle’s, special order, or custom, accounts for fully 55 percent of the business today. “We even do a lot of custom in motion now,” Easter says. “Our story is pretty simple. You can get it off the shelf and we’ve got it in stock, but if you want to wait just 30 days, you can get exactly what you want.”

“My whole store, my entire business, is based around options,” Thompson says, “and I see that as the future of the furniture industry, because having options is the only way you can live large in smaller environments. The big-box guys literally do it with space and the number of SKUs they offer, but for the rest of us, the ability to give customers options and do it affordably is what will keep you relevant.”

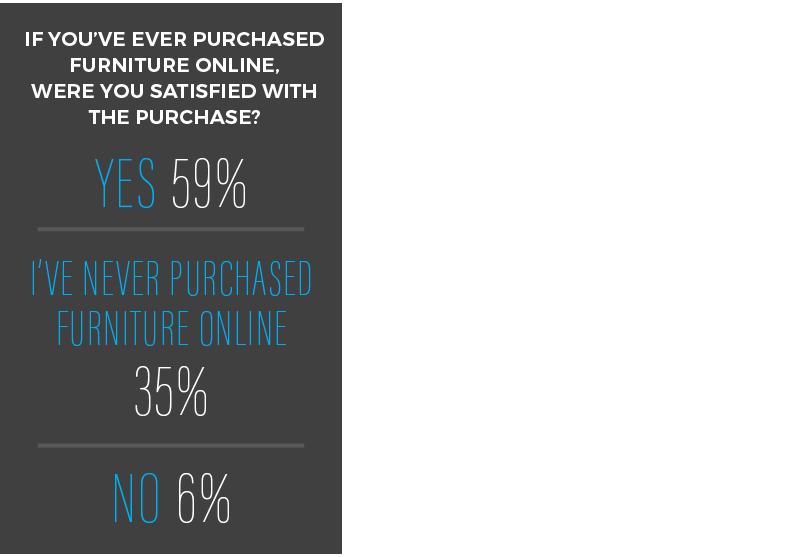

Online Satisfaction

Given the number of respondents who report being satisfied with furniture purchases made online, staying relevant matters for brick-and-mortars. Matthews, for one, plans to supplement the in-store experience at Brown Squirrel with an online buying experience in the year ahead. “We’re in a unique market here in Knoxville, and we still feel we can give the customer a better experience here at our store, but we have to keep evolving, and for items of convenience, online is the way to go.”

“The internet is still primarily focused on entry price points in furniture,” Thompson says. “They are selling non-option-based pieces and a certain demographic is looking for the most affordable solution. Those customers don’t really have high expectations. My customers don’t like buying online. They don’t like risk, and the majority that come into our store that have bought online swear they will never do it again because it was a first-class train wreck. When you go to a McDonald’s and you get the McDouble for $1.69 and it comes out of the wrapper looking nothing like the picture on the menu board, nobody goes back in and says, ‘Whoa, whoa, hold up! This doesn’t look at all like what you said it would,’ because they know, subconsciously, that they did not buy the right to that opinion at that price. So, I think you have to take this with a grain of salt. People might say they were satisfied, but we don’t know what level of expectation they had.”